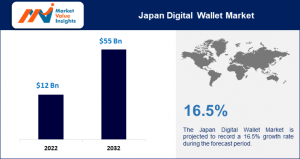

Japan Digital Wallet Market size was crossed over USD 12 Billion in 2022 and is projected to record more than 16.5% growth rate from 2023–2032

PUNE, MAHARASHTRA, INDIA, August 19, 2023/EINPresswire.com/ — Japan Digital Wallet Market size is predicted to experience tremendous growth in the near future. Our research indicates that the market was crossed over USD 12 Billion in 2022 and is projected to record more than 16.5% growth rate from 2023–2032, reaching a valuation of approximately USD 55 Billion by the end of the forecast period.

The COVID-19 pandemic has had a tremendous impact on the world, causing immense human suffering, economic damage, and significant changes to the health, social, and environmental sectors. According to WHO, as of December 31, 2020, over 82 million people have been infected and 1.8 million have died from the virus. Supply chain management has struggled with the sudden increase in demand for certain products and the restrictions on travel and production that have been in place since the pandemic began. Companies are trying to adapt to the new reality, and changes that will persist after the pandemic is over are likely to emerge.

Application Scope: Reimagining Convenience

The meteoric rise of digital wallets in Japan is not just a trend; it’s a reflection of the fusion of convenience and versatility in modern financial transactions. These digital wallets, initially introduced as an alternative to conventional payment systems, have seamlessly integrated into everyday life. From effortless point-of-sale purchases in brick-and-mortar stores to facilitating frictionless online shopping, digital wallets have woven themselves into the fabric of society.

However, the utility of these digital marvels extends far beyond the realms of retail. As the era of contactless payments dawns, digital wallets have solidified their status as the ultimate choice for public transportation. From trains and buses to taxis, commuters are now breezing through their daily journeys with a simple swipe of their smartphones. Furthermore, the amalgamation of loyalty cards, coupons, and rewards within these wallets has redefined the consumer experience, motivating users to streamline their financial activities within a single tech-driven hub.

Demand Surge: Bridging Tradition and Innovation

The skyrocketing demand for digital wallets in Japan is a fascinating narrative interwoven with a multitude of factors. At the forefront is Japan’s pioneering prowess in technology, fostering an environment conducive to the growth of innovative financial solutions. The Japanese populace’s affinity for futuristic gadgets, combined with its reputation for precision engineering, has paved the way for the adoption of cutting-edge payment technologies. This transition from conventional to digital payments aligns seamlessly with the nation’s drive towards a high-tech future.

Yet, the transformation in demand is not solely driven by technological influences. Japan’s cultural dynamics, which blend traditional values with modern aspirations, play a pivotal role in shaping consumer preferences. The younger generation’s fascination with technology and a penchant for convenience has propelled the usage of digital wallets. As traditional cash-centric behaviors undergo evolution, digital wallets serve as bridges connecting generations and lifestyles.

Market Value Insights conducted a comprehensive analysis of the Japan Digital Wallet Market, utilizing a 360-degree approach that combines both primary and secondary research methods. This approach allowed us to gain a deep understanding of the current market conditions, including the supply-demand balance, pricing trends, customer preferences, and other important factors.

Our primary research involved collecting insights from industry experts and opinion leaders from around the world, allowing us to validate our findings and gain a broader perspective of the market. To ensure the accuracy and reliability of our data, we employed various market estimation and data validation techniques and developed a proprietary model to forecast market growth until 2032. By using these research methods, we provide our clients with a comprehensive understanding of the Japan Digital Wallet Market, allowing them to make informed business decisions and stay ahead of the competition.

Download Free Sample Report @

https://www.marketvalueinsights.com/request-sample/331

Fueling Growth: Catalysts for Evolution

The growth of digital wallets in Japan is propelled by a confluence of economic, technological, and regulatory drivers, converging to forge a new financial trajectory. A driving force is the government’s resolute push towards a cashless society. Acknowledging the inefficiencies of paper currency and recognizing the potential for economic growth through digital transactions, the Japanese government has rolled out incentives and subsidies, prompting businesses to embrace cashless payment methods. This top-down approach has not only expedited adoption but also nurtured an ecosystem conducive for digital wallet providers to flourish.

Moreover, the ubiquity of smartphones as modern essentials has significantly bolstered this growth. As smartphones become extensions of personal identity, embedding financial functionalities within these devices streamlines the user experience and encourages seamless transitions to digital wallets. The unparalleled accessibility of smartphones further augments adoption rates, particularly in a society where mobile phones have become indispensable companions.

Collaborations between financial institutions, technology behemoths, and retailers constitute yet another critical growth driver. These partnerships have facilitated the creation of comprehensive digital wallet ecosystems, offering an array of services beyond payments. From financial management tools to investment opportunities, these ecosystems have positioned digital wallets as holistic financial companions catering to both basic and complex monetary needs.

A Glimpse into the Future

Japan’s enthusiastic embrace of digital wallets signals not just a shift in payment methods but an overhaul of its entire financial landscape. The seamless integration of technological prowess, cultural shifts, and strategic government initiatives has given rise to an unprecedented demand for these innovative financial tools. As the application scope widens, digital wallets are morphing into indispensable daily companions. As growth drivers continue to sculpt this trajectory, the evolution of digital wallets in Japan stands as a beacon for nations worldwide, navigating their own course towards an empowered, digitally-enabled financial future.

Source – Digital Wallets Market Size Worth USD 55 Billion by 2032 in Japan

Rohit Gujar

Digital Pulse HQ

[email protected]

Visit us on social media:

Twitter

![]()

Originally published at https://www.einpresswire.com/article/650835368/digital-wallets-market-size-to-cross-usd-55-billion-by-2032-in-japan